BITCOIN Is The Second Most-Searched Global News Term Of 2017

BITCOIN Is The Second Most-Searched Global News Term Of 2017

BITCOIN GOLD Price Predictions 2018 Crypto

Internet data mining expert Clif High has a brand new report called “Soaring Twenties.” Clif High says there is good news coming, but not just for 2018, many years after.

Clif High explains, “There is a really interesting set of data that’s been building for some time, and we have had this big flush of long term data, which is why I decided to do this report that is going out five years. I named it the “Soaring Twenties,” even though we are not into the 2020’s. . . . Our 2020’s, to some extent, are replicating the kind of language in the newspapers and limited news reels they had at the time of the 1920’s. Only instead of being “The Roaring Twenties,” we’re going to have a “Soaring Twenties.”

CLIF HIGH WebBot Data Miner | $600oz SILVER | China Promoting BITCOIN!

Clif High also talks about a coming “bond debacle,” soaring gold and silver prices in 2018 . . . the future of Bitcoin and other crypto currencies, “legal actions will be taken” against the bad actors in government and the “Deep State.” Clif High also predicts some “fantastic levels of business failures.” Join Greg Hunter as he goes One-on-One with Clif High of HalfPastHuman.com.

Visit Anarchapulco 2018: https://anarchapulco.com

Latest Alta Reports, Web Bot Forecasts 2018, Major Changes Ahead, Bitcoin Bonanza, Clif High

Bitcoin To Hashgraph: The Crypto Revolution – Hidden Secrets Of Money Ep 8 – Mike Maloney

Bonus Features: https://www.hiddensecretsofmoney.com Today, mankind stands at a crossroads, and the path that humanity chooses may have a greater impact on our freedom and prosperity than any event in history. In 2008 a new technology was introduced that is so important that its destiny, and the destiny of mankind are inextricably linked.

It is so powerful that if captured and controlled, it could enslave all of humanity. But if allowed to remain free and flourish – it could foster unimaginable levels of peace and prosperity. It has the power to replace all financial systems globally, to supplant ninety percent of Wall St, and to provide some functions of government. It has no agenda.

It’s always fair and impartial. It can not be manipulated, subverted, corrupted or cheated. And – it inverts the power structure and places control of one’s destiny in the hands of the individual. In the future, when we look back at the 2.6 million-year timeline of human development and the major turning points that led to modern civilization – the creation of farming, the domestication of animals, the invention of the wheel, the harnessing of electricity and the splitting of the atom – the sixty year development of computers, the internet and this new technology will be looked upon as a single event…a turning point that will change the course of human history.

It’s called Full Consensus Distibuted Ledger Technology, and so far its major use has been for cryptocurrencies such as Bitcoin….but its potential goes far, far beyond that. The Crypto Revolution: From Bitcoin to Hashgraph is our latest episode of Hidden Secrets of Money. It’s about the evolution of cryptocurrencies and full consensus distributed ledger technology, and how they will change our world. I believe that this video is by far the easiest way for the average person to gain an understanding of what cryptocurrencies are and how they work, but more importantly, the immense power of full consensus distributed ledger technology and the impact it will have on our daily lives.

I have an absolute passion for monetary history and economics, and I love teaching them. Cryptocurrencies are our future, and there is no escaping it… this is the way everything will be done from now on. But, we now stand at a crucial turning point in history. Full consensus ledgers such as Blockchain and Hashgraph have the power to enslave us, or free us… it all depends on how we choose to use them.

If we choose to support centralized versions issued by governments and the financial sector we will be granting them more control over our daily lives. Politicians and bureaucrats will be able raise taxes instantly, whenever they want, on every dollar you make as you make them, and every dollar you spend as you spend them.

If they think the economy needs stimulating they’ll be able to enforce huge negative interest rates, effectively punishing you for not spending everything you earn before you earn it. They’ll be able to decide where you can go and where you can’t, what you can buy and what you can’t, and what you can do and whatever they decide you can’t do… and if they don’t like you, they can just disconnect you from the monetary system. So, will the monetary system become fully distributed and help to free mankind, or will it be centralized and enslave us? The choice is in front of us right now, and our decisions will create our future.

I believe that this will be a binary outcome, there is no middle ground, it will either be one future or the other. The question is, will it be the future we want? Or the future they want? I’m a precious metals dealer and one thing I’ve learned is that gold, silver, and now free market decentralized cryptocurrencies, represent freedom. Because of this knowledge I started investing in crypto currencies long ago and also became one of the first precious metals dealers to accept bitcoin as payment for gold and silver.

I would really appreciate it if you could share this video with everyone you know. I think it’s very important that as many people as possible find out about the changes to the global monetary system that are happening right now… nothing will affect us more, and everyone’s future depends on it. Thanks, Mike If you enjoyed watching this video, be sure to pick up a free copy of Mike’s bestselling book, Guide to Investing in Gold & Silver: https://goldsilver.com/buy-online/inv…

Economist Jim Rickards On Gold Versus Bitcoin

WHAT IS Bitcoin | Cryptocurrency

Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. … Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto and released as open-source software in 2009.

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, to control the creation of additional units, and to verify the transfer of assets.

Mining Bitcoins in Iceland

Bitcoin Predicted Twenty Years Ago

James Dale Davidson and Lord William Rees-Mogg wrote a curiosity: a history book focused upon the coming future. Humanity, they urged, was involved in a great transition. Audacious, weird, and at times just plain creepy, the duo managed to hammer out what amounts to cryptocurrency in eerie exactness to its real-life form, bitcoin, a full ten years before anyone, including Satoshi Nakamoto.

Mr. Davidson met Lord Rees-Mogg while at Oxford nearly forty years ago. A chance encounter over antiquarian book searches ended up in a friendship and a working relationship lasting decades. It first evolved into newsletters, which then became books such as Blood in the Streets, The Great Reckoning, and, of course, The Sovereign Individual, the subject to which we return.

“Inevitably, this new cybermoney will be denationalized. When Sovereign Individuals can deal across borders, Control over money will migrate from the halls of power to the global marketplace, Free Money, Free People.

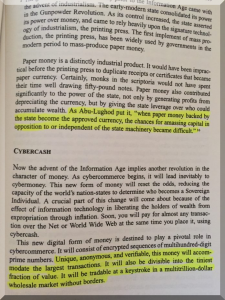

Freeing money means freeing people. They explain, “Each transaction will involve the transfer of encrypted multi-hundred-digit prime number sequences. Unlike the paper-money receipts issued by governments during the gold-standard era, which could be duplicated at will, the new digital gold standard or its barter equivalents will be almost impossible to counterfeit for the fundamental mathematical reason that it is all but impossible to unravel the product of multi-hundred-digit prime numbers. All receipts will be verifiably unique,” which is so exactly spot-on it can take a reader’s breath.

“The verifiability of the digital receipts rules out this classic expedient for expropriating wealth through inflation. The new digital money of the Information Age will return control over the medium of exchange to the owners of wealth, who wish to preserve it, rather than to nation-states that wish to spirit it away.”

“Use of this new cybermoney will substantially free you from the power of the state,” becomes their almost anarchic thesis.

| 10 Most Commonly Googled Questions About Bitcoin |

The whole world seems to be talking about Bitcoin these days, but not everyone knows exactly what it is or how it works. So MONEY went to Google to get the most popular Bitcoin-related queries, and then Investopedia put together a list of answers to your top 10 questions.

- What is Bitcoin?

Launched in 2009 by an anonymous creator who goes by the pseudonym Satoshi Nakamoto, Bitcoin is the most well-known and most widely adopted “cryptocurrency.”

Based on a technology known as blockchain, Bitcoin exists as ledger entries across a distributed, decentralized computer network with no central authority or government overseeing it. By employing blockchain technology in combination with sophisticated encryption, Bitcoin offers a way to securely send digital money in a truly peer-to-peer fashion.

- How do you buy Bitcoin?

Bitcoin can be purchased using traditional currencies such as dollars, but it can also can be purchased using other digital currencies such as Ethereum or Litecoin. There are a several online exchanges where you can buy and sell Bitcoin.

- Where can you buy Bitcoin?

The most common place to buy Bitcoin is through online exchanges. However, the trustworthiness and security of these exchanges can vary, and there are several high-profile hacks of Bitcoin exchanges in the past.

Look for an exchange that is regulated. In the United States, Coinbase and its subsidiary GDAX are considered trustworthy options.

- How to invest in Bitcoin?

Many buyers of Bitcoin and other cryptocurrencies believe that these technologies can revolutionize the financial world and disrupt the status quo.

They see bitcoin as an asset similar to gold, and they follow a long-term buy-and-hold strategy. (True believers call this “HODL” – originally a typo for ‘hold’ on a discussion forum, users now take it to mean “hold on for dear life.”) If you want to HODL, you’ll want to transfer your holdings to a Bitcoin wallet where you can keep them safe until you’re ready to use them or sell.

While some established online brokers such as Vanguard have no plans to offer Bitcoin funds, other well-regarded brokerages, including TD Ameritrade and E*Trade, offer investors the opportunity to buy futures contracts on Bitcoin for those who want to invest without owning the underlying asset.

- How does Bitcoin work?

Bitcoin works by recording every transaction that takes place on its network in all nodes of the network. This redundancy ensures that a bad actor cannot change or delete a transaction by undermining a single point of failure.

Each user of the Bitcoin system has a public-private encrypted key pair, and use their public keys as their account number or address. For instance, if Alice sends Bob one Bitcoin, she will send it to Bob’s public key address. Transactions themselves are validated and added to the blockchain ledger through a process called “mining,” which also is the method by which new Bitcoins are introduced to the system.

- What is Bitcoin mining?

Bitcoin mining is the mechanism by which new Bitcoins are brought into existence. At the same time, it is the way that transactions are validated and confirmed.

Mining involves solving a computationally difficult cryptographic puzzle, similar in some ways to an enormous game of Keno where the “winner” is determined by chance according to probability alone. The participant in the mining network who is able to solve this puzzle first claims as their reward newly minted Bitcoins (currently 12.5 BTC per block) as well as all the accumulated transaction fees associated with that block.

- How do you mine for Bitcoin?

Bitcoin is an open system, so anybody can join the network as a miner.

Mining isn’t easy though; miners need specific hardware designed to solve the cryptographic mining puzzle using dedicated microchips (known as ASICs) or by rigging together a series of graphics processor units, or GPUs (which have been found to solve cryptocurrency mining puzzles better than traditional CPUs).

Once you have your hardware, you’ll probably want to join a mining pool that aggregates individual mining efforts from all over the world and concentrates that effort. If the pool solves the mining puzzle, each member of the pool receives a pro-rated amount that corresponds to how much mining power they contributed.

- How many Bitcoins are there?

One unique feature of Bitcoin is that there can only be 21 million ever mined. So far, approximately 17 million have been produced — almost 80% of the total supply.

In addition, the rate of new Bitcoin creation is fixed at an average of one block (currently 12.5 BTC) every ten minutes. This “block reward” also reduces over time, so that every four years or so the number of Bitcoins found in a block is cut in half. When Bitcoin launched there were 50 BTC per block and some time in the year 2020, that amount will again be reduced to 6.25 BTC per block.

SPONSORED FINANCIAL CONTENT

- How much is a Bitcoin worth?

As of January 23, 2018 one bitcoin was worth approximately $11,000. As recently as December 2017, the price of a Bitcoin rose to nearly $20,000 amid increasing speculative interest and global demand.

To put this in perspective, a Bitcoin was worth less than $1 from 2009-2011, less than $100 until 2013, and less than $1,000 until 2017 (excluding a short price spike to $1,200 in late 2013). There are lots of questions around what Bitcoin’s price should be, with some claiming it has zero intrinsic value and others claiming that it could be worth as much as $100,000 per bitcoin or more.

- What is Bitcoin Cash?

Bitcoin Cash is the result of a “hard fork,” which is a splitting of the blockchain into two distinct new ledgers, but both preserving whatever came before it.

One of the new chains maintains the original protocol and code while the second forks off in order to implement new code or add additional features and functionality.

Bitcoin Cash forked off in order to increase the number of transactions that can fit inside of a block in an effort to reduce transaction fees and confirmation times, but this has created something of an ideological split in the Bitcoin community among those who claim that one versus the other embodies the “original spirit” of the Bitcoin project.